Introduced in the 1930s, the Federal Crop Insurance Program protects farmers across the country from loss of harvest or revenue.

While individual crop insurance policies are administered by independent companies across the US, the federal government provides oversight as well as premium subsidies. This keeps costs and protections consistent among farmers of the same size, regardless of location.

Whether or not you should have crop insurance depends on your particular situation and needs, but it’s definitely worth considering. Farming has always been an unpredictable way to make a living, but crop insurance essentially guarantees you a certain level of profit. With so many natural and commercial challenges facing the current generation of farmers, one bad or disappointing year can make or break a farm. Keep reading to learn more about what crop insurance is, how it works, and the benefits it provides.

What is Farm Crop Insurance?

Farmers, ranchers, and other agriculture business owners can purchase crop insurance policies to protect them against losses that hurt their bottom line. The USDA oversees two agriculture insurance programs:

Noninsured Crop Disaster Assistance Program (NAP)

Administered by the Farm Service Agency, this program offers financial support to growers of non-insurable crops. So if you grow specialty crops that aren’t eligible for crop insurance, you can turn to the NAP in the event that a natural disaster keeps you from planting or leads to low crop yield or inventory loss.

Federal Crop Insurance Corporation (FCIC)

Under the Risk Management Agency, the FCIC oversees USDA crop insurance providers nationwide in order to ensure consistency and support economic stability in the agriculture industry. The RMA provides underwriting for crop and livestock insurance policies sold by private insurance companies. More than 100 types of crops are eligible for insurance and there are multiple add-on features to consider. Generally, your crop insurance policy will fall into one of two categories: protection against loss of crops due to natural disasters or protection against loss of profit due to fluctuations in the price of agricultural commodities.

How Does Crop Insurance Work?

American farmers can purchase crop insurance through an eligible private insurance company. You can

search for local agents through the USDA’s listings. While all insurers offer the same plans at the same price, it’s still worth comparing several companies before signing up. The quality of customer service may vary, so you want to find an insurance company that is friendly, knowledgeable, and responsive to your needs and questions. Often, a community bank like BTC can provide

excellent service as well as local crop insurance expertise.

While prices are consistent throughout the country, the type and size of crop(s) you grow will determine how much you pay for a crop insurance policy. The

USDA’s cost estimator can help you figure out the approximate cost of coverage for your farm. Producers of eligible crops can add government-subsidized Catastrophic Risk Protection Endorsement (CAT Coverage) to their crop insurance policy at no additional cost beyond a $300 administrative fee per crop.

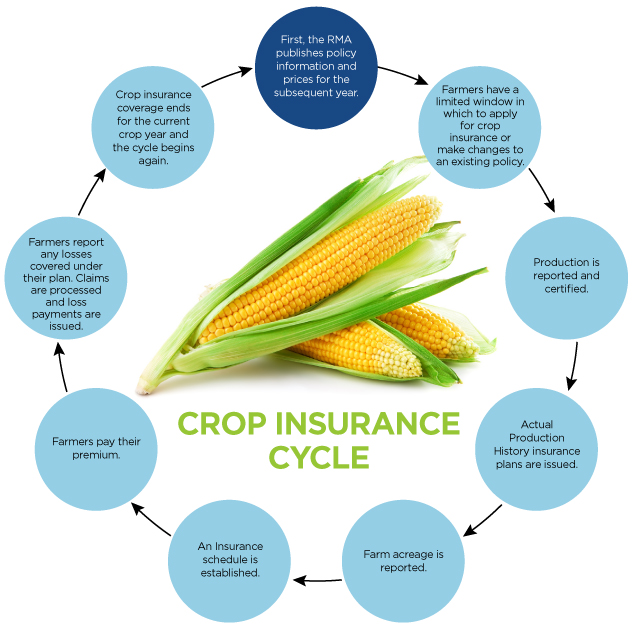

Time and dates are very important to crop insurance, which works on a specific cycle:

- First, the RMA publishes policy information and prices for the subsequent year.

- Farmers have a limited window in which to apply for crop insurance or make changes to an existing policy.

- Production is reported and certified.

- Actual Production History insurance plans are issued.

- Farm acreage is reported.

- An Insurance schedule is established.

- Farmers pay their premium.

- Farmers report any losses covered under their plan. Claims are processed and loss payments are issued.

- Crop insurance coverage ends for the current crop year and the cycle begins again.

Make sure you understand all the deadlines and requirements associated with your crop insurance policy. Failure to comply could disqualify you from receiving some or all of the benefits.

What Does Crop Insurance Cover?

There are two main types of crop insurance plans: crop-yield and crop-revenue. The first type protects farmers against loss of inventory due to natural disasters. The second covers lost revenue due to price fluctuations. However, within these two categories there are many options for policy add-ons. Also, specific policies are available for certain crops according to your state and county. Visit the

USDA’s crop and policy listing by state/county to see what you’re eligible for.

Crop Insurance Benefits

Crop insurance is a risk management tool for the agriculture industry. It provides support to farmers to help them maintain a profitable farm instead of closing due to loss of income or harvest. There is even a program for new farmers, “Beginning Farmer and Rancher (BFR) Benefits,” that makes crop insurance more accessible and affordable to those who are just starting out in agriculture.

The American public also benefits from a federal crop insurance program because it ensures a robust agriculture industry. This leads to a healthy rural economy and maintains the food supply across the country. While applying for crop insurance does require attention to detail and deadlines, as well as annual reporting, no farmer is guaranteed a profit at harvest time without crop insurance coverage.

Crop Insurance Planting Dates for Missouri and Iowa

One of the most important deadlines in the crop insurance timeline is the date your crops need to be planted by. Crop insurance planting dates change from year to year, and are determined by crop, state and county. Find the deadlines relevant to your Missouri farm on

this guide from the University of Missouri. Farmers in Iowa can view planting dates in

this Iowa State University article.

Need Help Choosing a Crop Insurance Company?

Crop insurance is not an FDIC insured product.